To this end, the latest draft law talks about the need to use “diverse methods such as statistical methods, modeling, and field certification” to conduct credit assessments and combine the data from different government agencies. “It gives only the vaguest hint that it’s a little more tech-y,” says Daum.

How are Chinese tech companies involved in this system?

Because the system is distinctively low-tech, the involvement of Chinese tech companies has been peripheral. “Big tech companies and small tech companies…play very different roles and they take very different strategies,” says Shazeda Ahmed, a postdoctoral researcher at Princeton University, who spent several years in China studying how tech companies are involved in the social credit system.

Smaller companies, contracted by city or provincial governments, largely built the system’s tech infrastructure, like databases and data centers. On the other hand, large tech companies, particularly social platforms, have helped the system spread its message. Alibaba, for instance, helps the courts deliver judgment decisions through the delivery addresses it collects via its massive ecommerce platform. And Douyin, the Chinese version of TikTok, partnered with a local court in China to publicly shame individuals who defaulted on court judgments. But these tech behemoths aren’t really involved in core functions, like contributing data or compiling credit appraisals.

“They saw it as almost like a civic responsibility or corporate social responsibility: If you broke the law in this way, we will take this data from the Supreme People’s Court, and we will punish you on our platform,” says Ahmed.

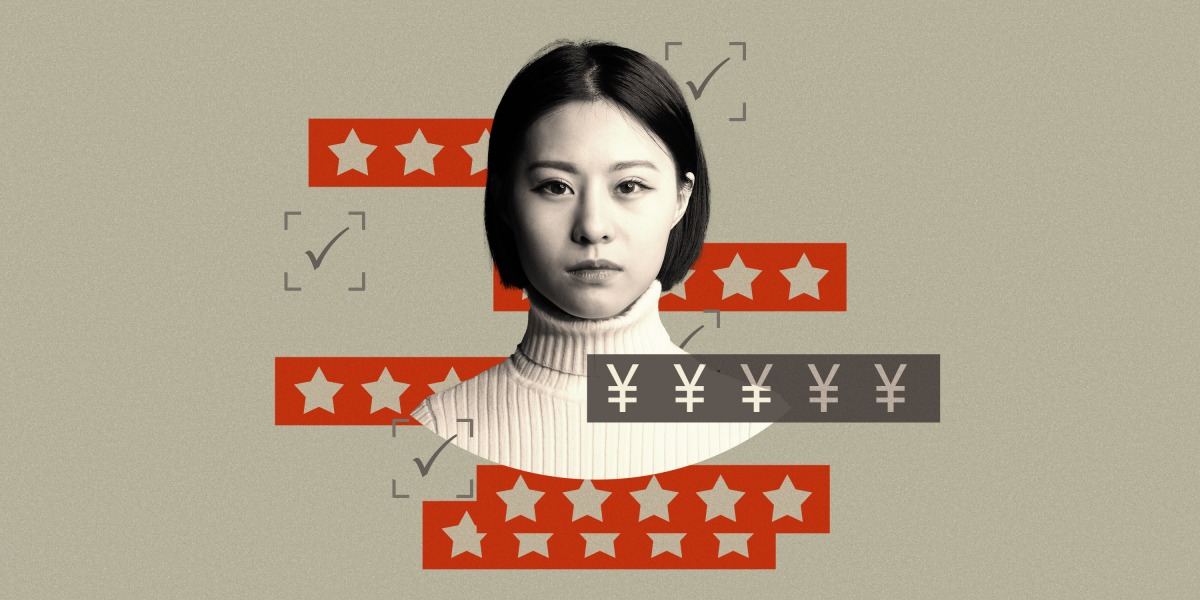

There are also Chinese companies, like Alibaba’s fintech arm Ant Group, that have built private financial credit scoring products. But the result, like Alibaba’s Sesame Credit, is more like a loyalty rewards program, according to several scholars. Since the Sesame Credit score is mostly calculated based on users’ purchase history and lending activities on Alibaba’s own platforms, the score is not reliable enough to be used by external financial institutions and has very limited effect on individuals.

Given all this, should we still be concerned about the implications of building a social credit system in China?

Yes. Even if there isn’t a scary algorithm that scores every citizen, the social credit system can still be problematic.

The Chinese government did emphasize that all social credit-related punishment has to adhere to existing laws, but laws themselves can be unjust in the first place. “Saying that the system is an extension of the law only means that it is no better or worse than the laws it enforces. As China turns its focus increasingly to people’s social and cultural lives, further regulating the content of entertainment, education, and speech, those rules will also become subject to credit enforcement,” Daum wrote in a 2021 article.

Secondly, “this was always about making people honest to the government, and not necessarily to each other,” says Ahmed. When moral issues like honesty are turned into legal issues, the state ends up having the sole authority in deciding who’s trustworthy. One tactic Chinese courts have used in holding “discredited individuals” accountable is encouraging their friends and family to report their assets in exchange for rewards. “Are you making society more trustworthy by ratting out your neighbor? Or are you building distrust in your very local community?” she asks.

But at the end of the day, the social credit system is not (yet) an example of abuse of advanced technologies, like artificial intelligence, and it’s important to scrutinize it based on the facts. The November draft law is currently seeking public feedback for one month, though there’s no expected date on when it will pass and become law. It could still take years until we see the final product of a nationwide social credit system.